salt tax cap repeal 2021

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix No SALT no deal. Mondaire Jones NY-17 US.

House Democrats Working To Nest Salt Cap Repeal Into Reconciliation Package National Review

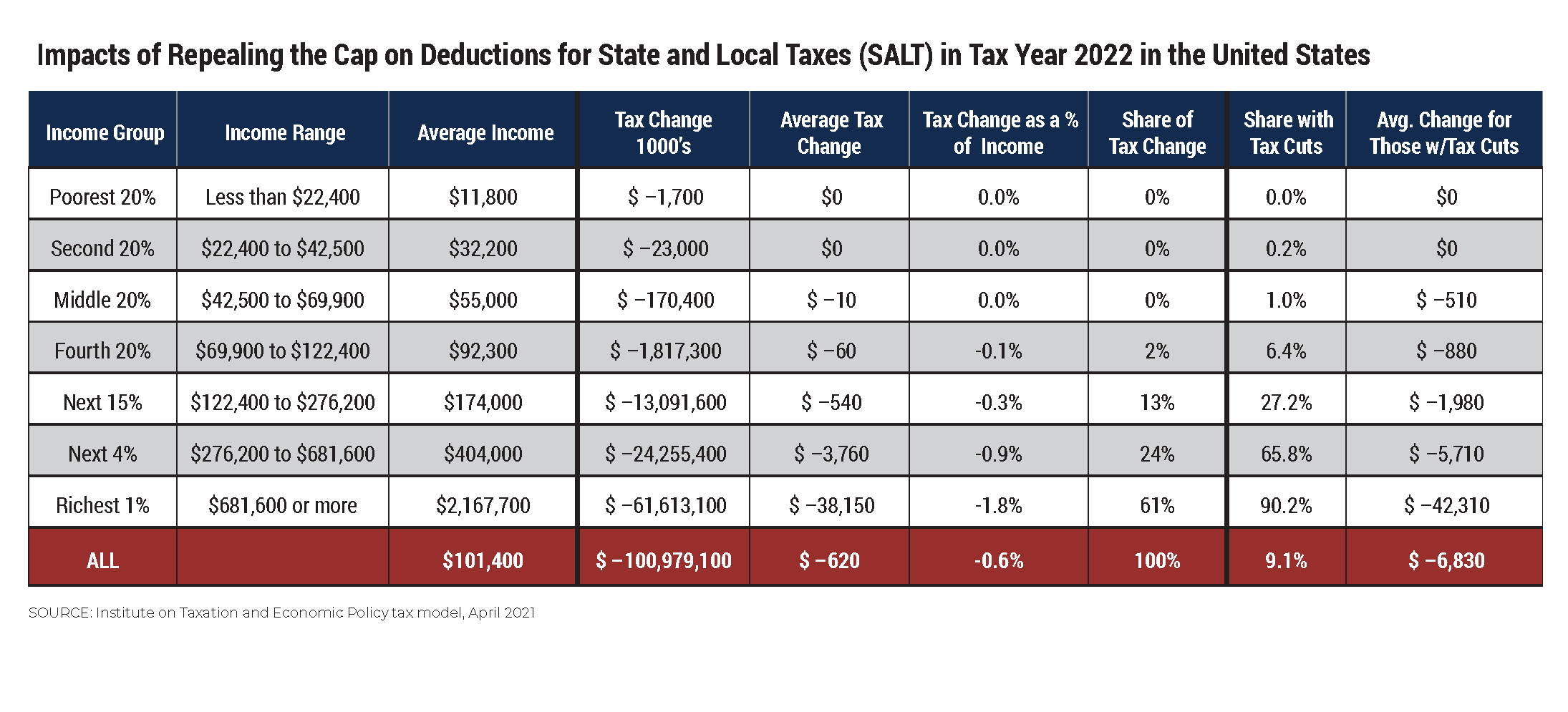

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states.

. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. Amid uncertainty in DC Cuomo is spinning a 4 billion state tax hike on higher-income people and businesses by saying New Yorkers will see a net reduction in taxes if the. Agreed Upon Procedures AUP Employee.

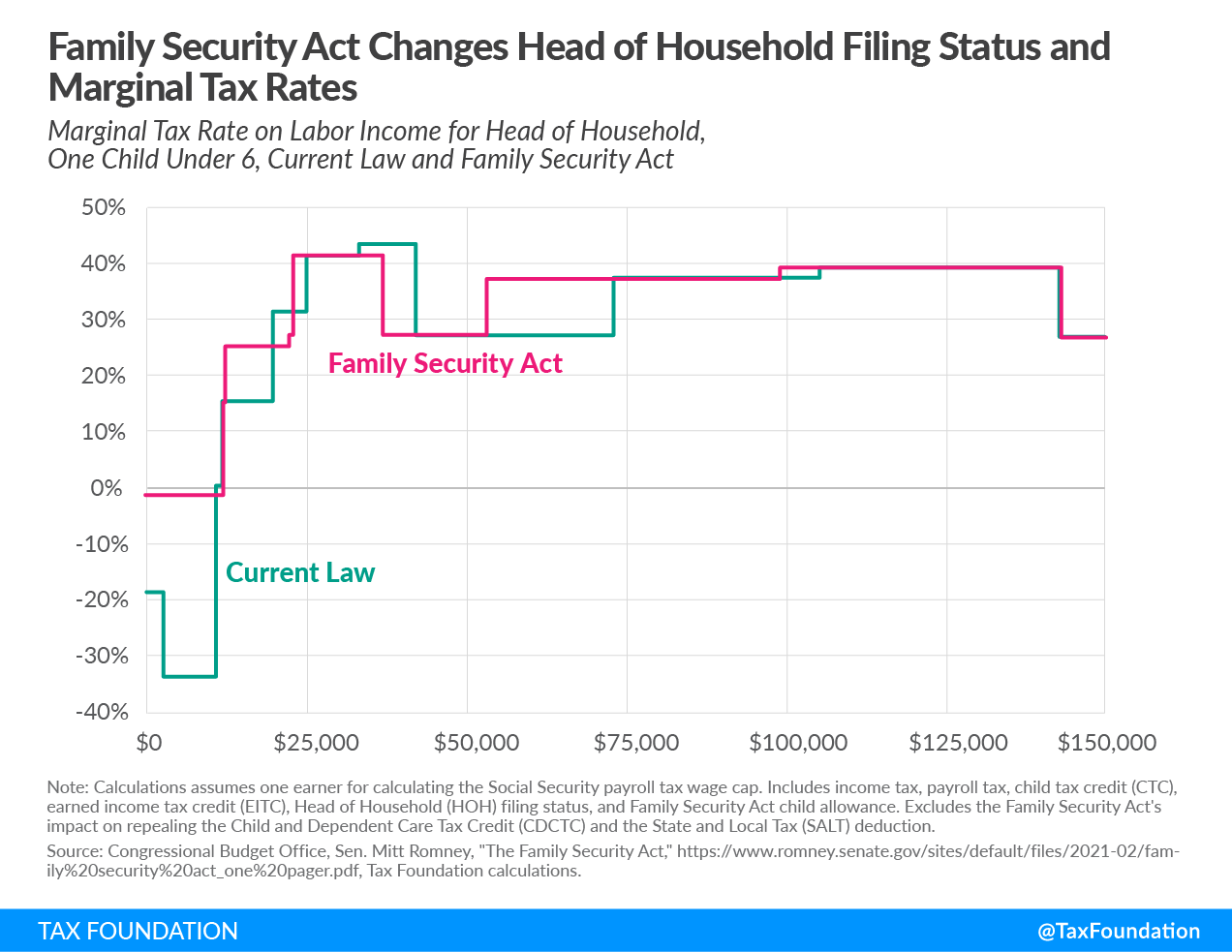

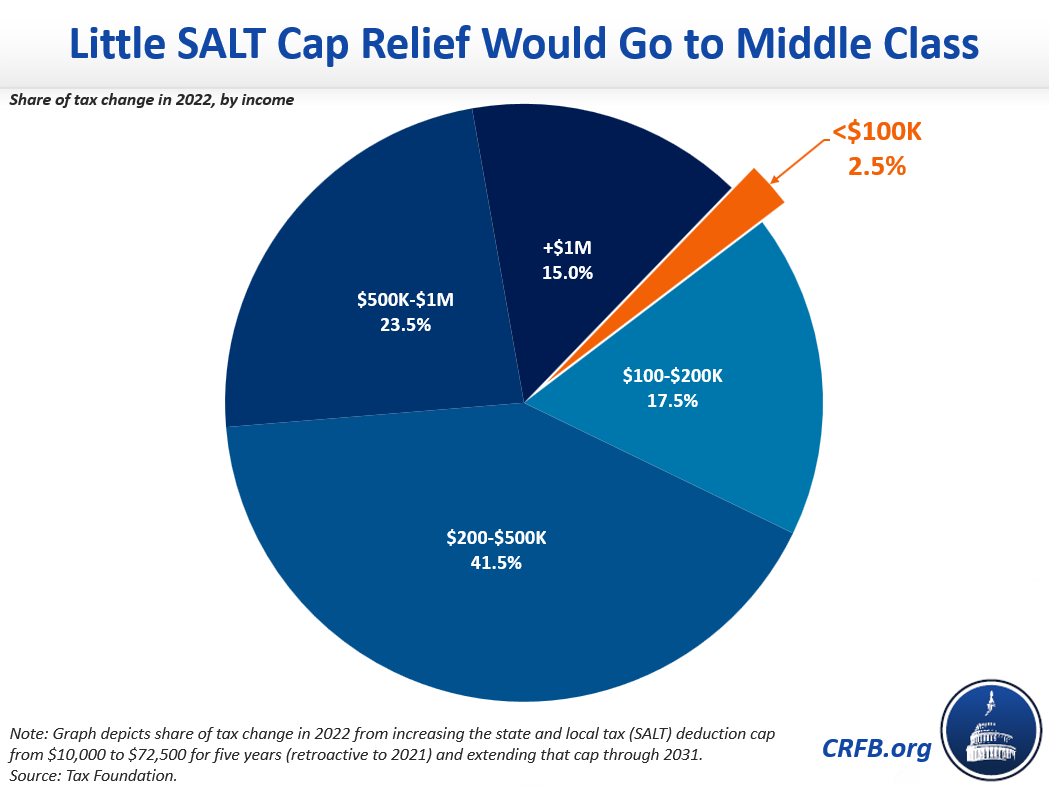

By Laura Davison News April 15 2021 at 0253 PM Share Print. The 10000 cap on state and local tax or SALT deductions imposed under the 2017 GOP-written tax overhaul is set to expire after 2025. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed.

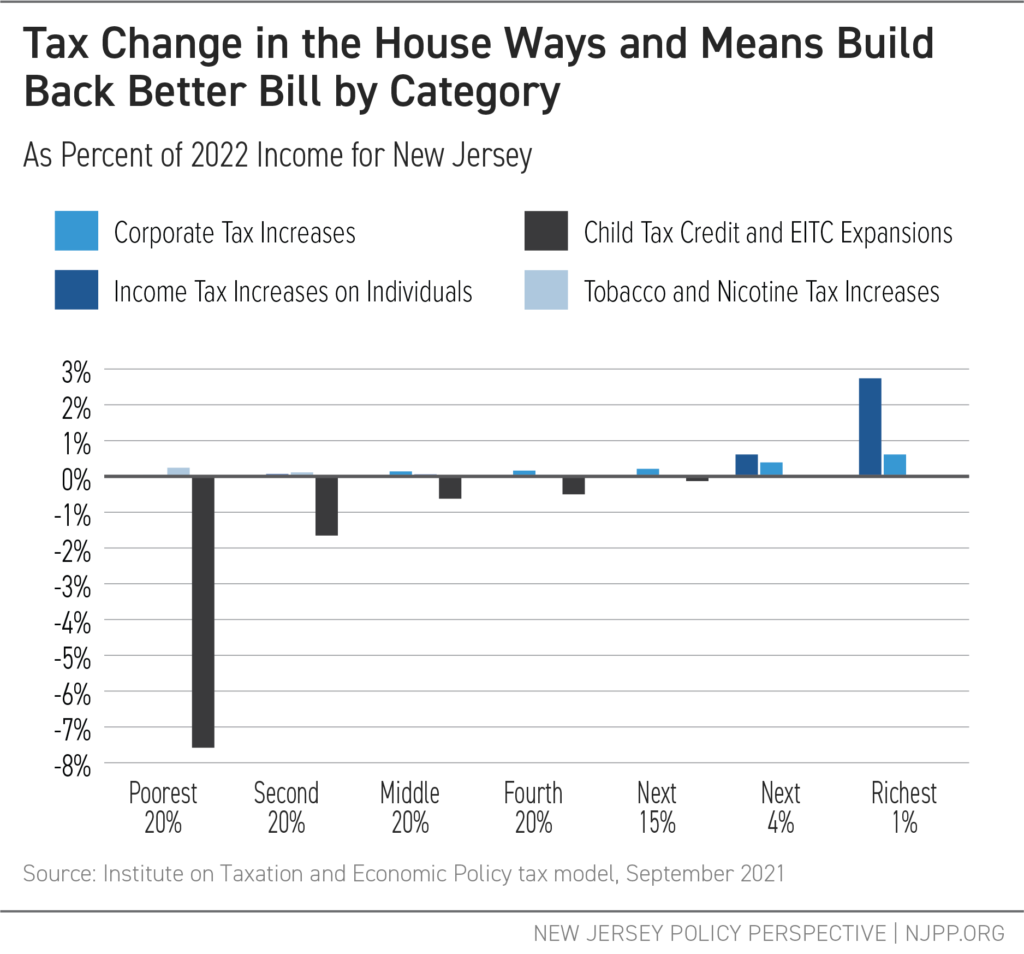

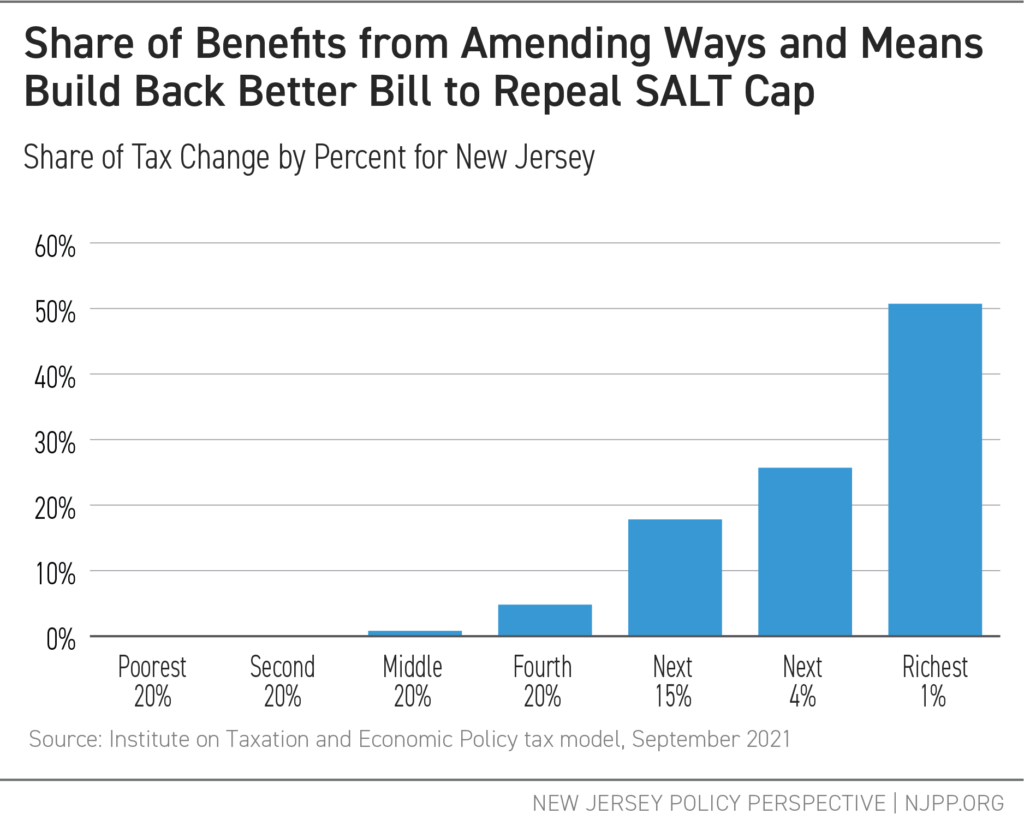

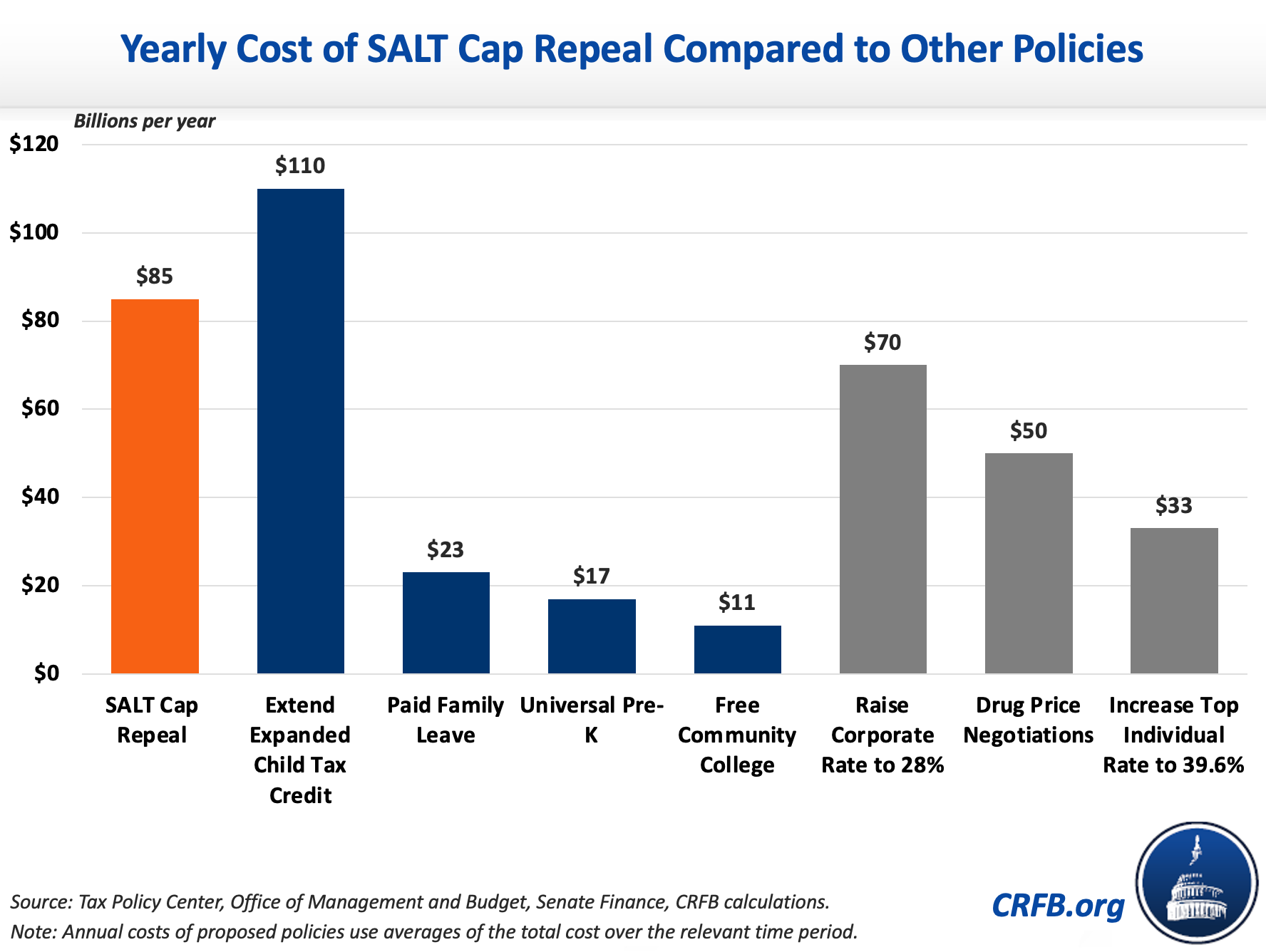

It allows people to deduct payments like state income and local property taxes from their federal tax bills. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better.

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. Salt Tax Cap Repeal 2021.

Salt Tax Cap Repeal 2021. Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the. The Tax Policy Center analysis says that a mere 3 of middle-class taxpayers would benefit from removing the cap and George Will in a recent column cited figures suggesting.

The deduction previously unlimited was capped at 10000 as part of the. Financial Planning Tax Planning. Salt Tax Cap Repeal 2021.

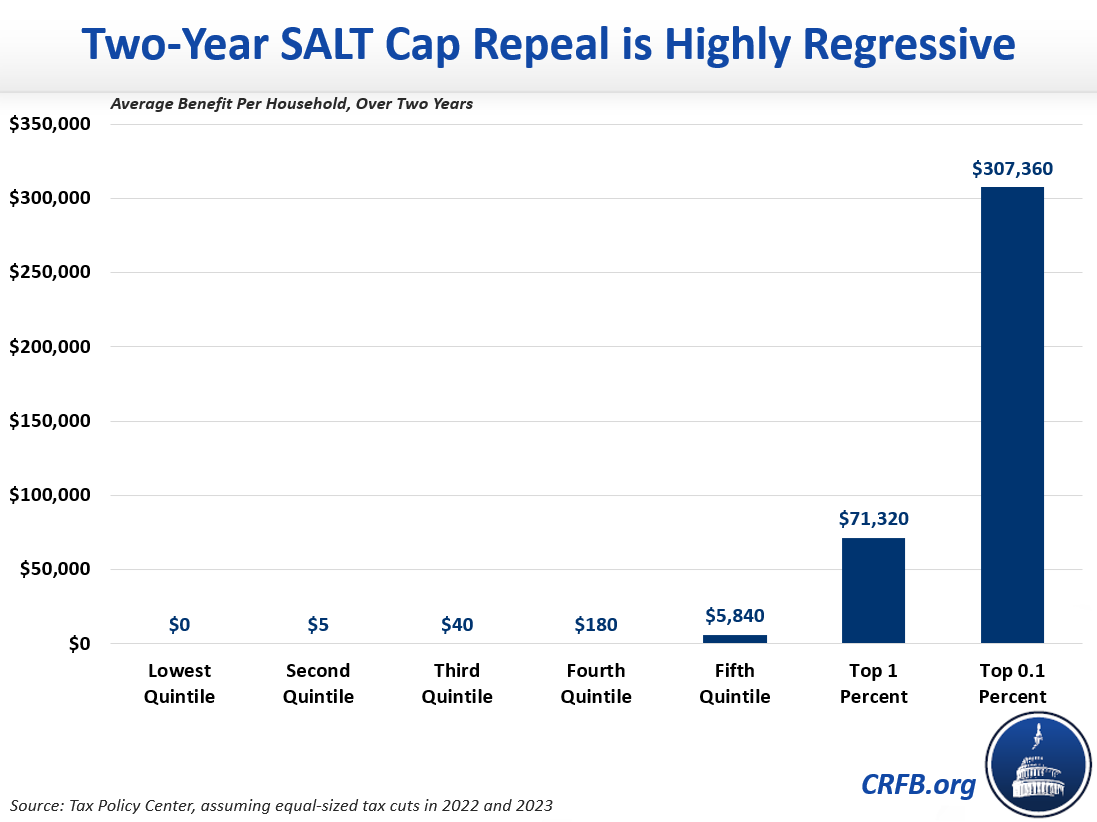

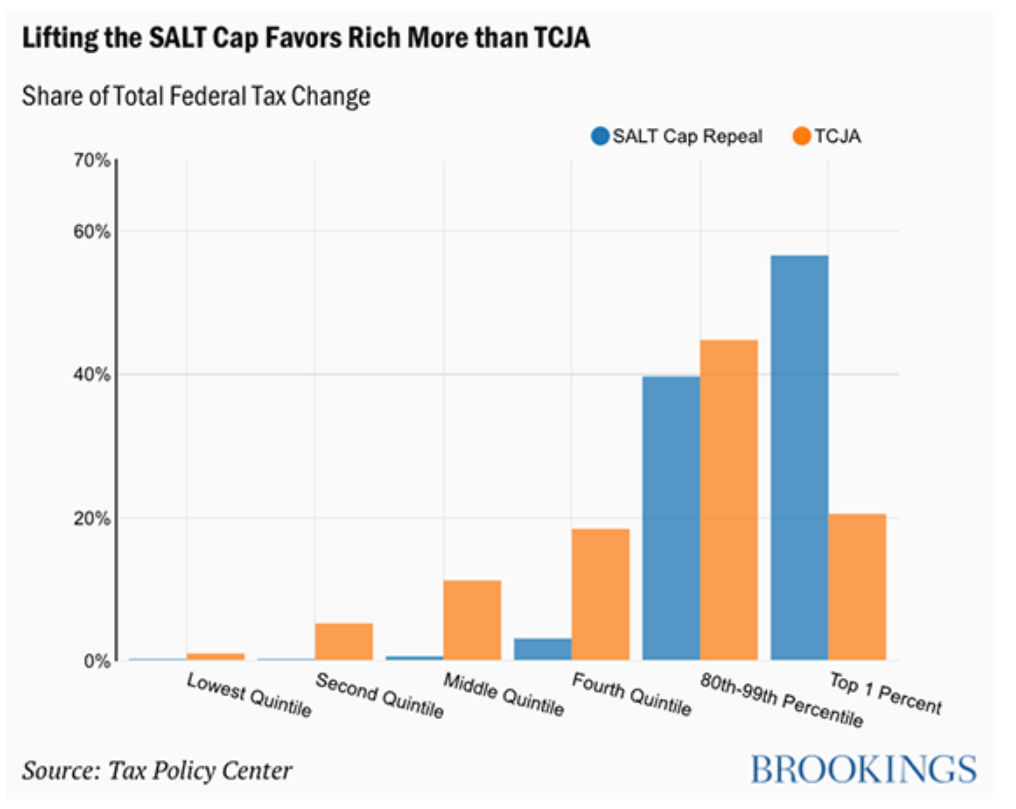

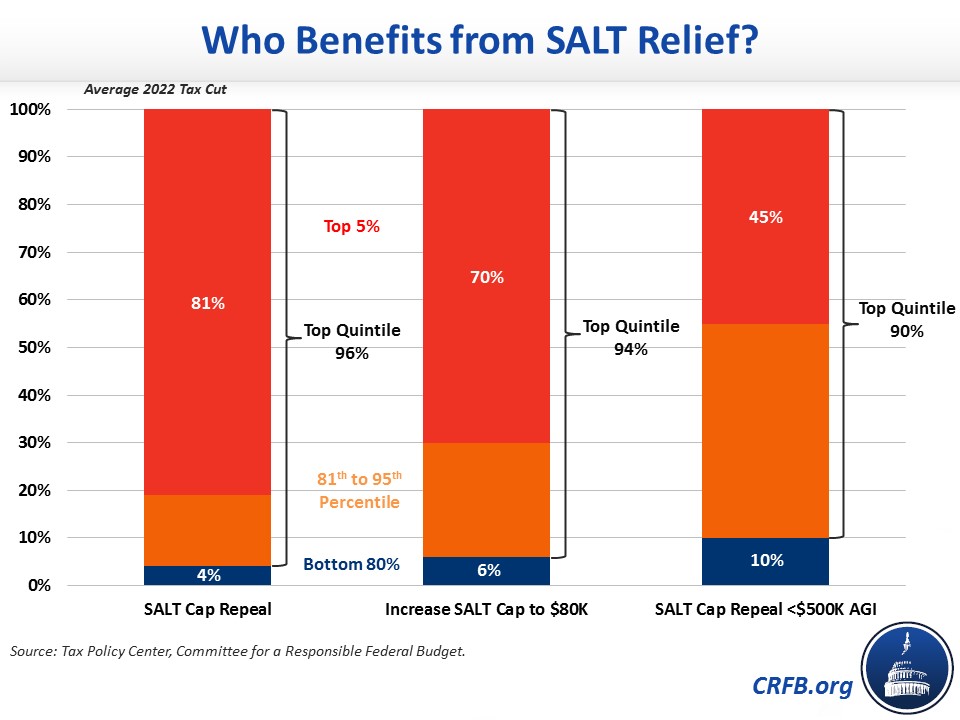

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. In urging repeal of. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

The Tax Foundation predicts that a full repeal of the cap. Over 50 percent of this reduction would accrue to. The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025.

SALT-Cap Repeal Gains Momentum. During negotiations in the Senate on the 737 billion spending bill Republicans like South.

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

U S House Passes Legislation To Repeal Salt Deduction Cap For Two Years Focus Turns To Senate Efforts

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

The Politics Of The Salt Cap Isn T Red Vs Blue Wsj

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

Marc Goldwein On Twitter 96 Of The Benefit Of The Salt Cap Deduction Repeal Would Go To Folks In The Top Quintile This Is Not A Middle Class Tax Cut Https T Co 2xnupxnvhd

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Heroic Congressional Fight To Save The Rich

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget